What Does Investment Consultant Do?

What Does Investment Consultant Do?

Blog Article

The Definitive Guide to Investment Consultant

Table of ContentsThe Basic Principles Of Tax Planning copyright What Does Financial Advisor Victoria Bc Mean?The Buzz on Retirement Planning copyrightThe Ultimate Guide To Tax Planning copyrightThe Facts About Retirement Planning copyright UncoveredThe Ultimate Guide To Lighthouse Wealth Management

“If you used to be to buy a product, state a tv or a pc, you might wish to know the requirements of itwhat are their parts and just what it may do,” Purda details. “You can remember purchasing financial information and help just as. Individuals need to know what they're buying.” With monetary guidance, it is important to keep in mind that the product is not securities, stocks and other financial investments.it is things like budgeting, planning for retirement or paying off debt. And like purchasing a pc from a reliable business, buyers need to know they might be purchasing economic advice from a trusted expert. One of Purda and Ashworth’s most fascinating results is around the costs that monetary coordinators demand their clients.

This presented genuine regardless the cost structurehourly, fee, possessions under control or predetermined fee (into the research, the buck value of fees ended up being the exact same in each situation). “It nonetheless relates to the worthiness idea and anxiety about consumers’ part which they don’t understand what they might be getting back in trade for those fees,” states Purda.

Getting My Independent Investment Advisor copyright To Work

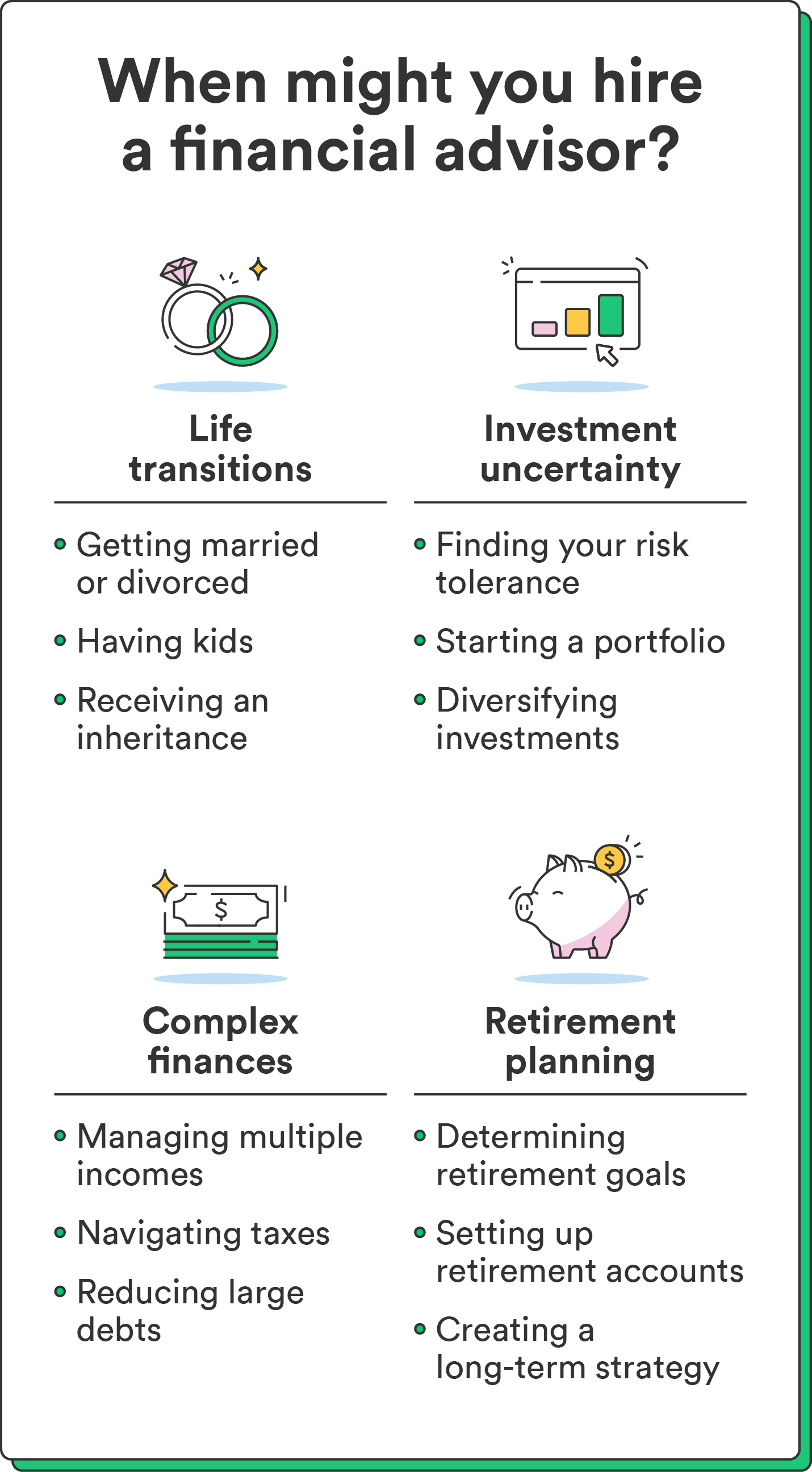

Hear this information as soon as you hear the definition of financial expert, what pops into the mind? A lot of people think of a professional who is going to give them monetary information, specially when you are considering spending. That’s an excellent place to begin, however it doesn’t decorate the complete photo. Not really near! Economic analysts might help people who have a lot of various other money goals as well.

An economic consultant will allow you to build wide range and protect it your long lasting. They may be able calculate your future monetary requirements and strategy methods to extend your own retirement savings. They're able to also advise you on when you should start experiencing Social protection and utilizing the amount of money within your retirement accounts so you're able to stay away from any nasty charges.

Some Known Details About Investment Consultant

They're able to guide you to ascertain exactly what mutual resources tend to be right for you and explain to you how-to control and work out many of your assets. Capable also support see the threats and what you’ll ought to do to quickly attain your goals. An experienced financial investment pro will help you stick to the roller coaster of investingeven as soon as your financial investments take a dive.

They're able to provide guidance you ought to generate plans to be sure that desires are performed. And also you can’t put a cost label throughout the peace of mind that include that. According to a recent study, the typical 65-year-old pair in 2022 needs around $315,000 stored to cover medical care prices in retirement.

The Main Principles Of Independent Investment Advisor copyright

Given that we’ve reviewed just what monetary analysts would, let’s dig inside various sorts. Here’s an effective principle: All monetary coordinators are financial advisors, not all experts are coordinators - https://www.twitch.tv/lighthousewm/about. A financial planner centers on assisting people create plans to reach lasting goalsthings like starting a college fund or preserving for a down cost on property

Exactly how do you understand which economic advisor suits you - https://www.domestika.org/en/carlosprycev8x5j2? Here are a few actions you can take to make sure you are really employing suitable person. What do you do if you have two bad choices to select? Easy! Get A Hold Of more possibilities. More options you have got, the more likely you are to create an excellent choice

Ia Wealth Management for Dummies

Our very own Intelligent, Vestor program makes it simple for you by showing you to five monetary analysts who is able to last. The good thing is actually, it’s completely free to obtain associated with an advisor! And don’t forget about to come calmly to the meeting ready with a list of concerns to inquire about in order to ascertain if they’re a great fit.

But listen, just because a consultant is smarter compared to the typical bear doesn’t provide them with the legal right to let you know what direction to go. Often, analysts are loaded with by themselves simply because they convey more degrees than a thermometer. If an advisor starts talking-down for you, it’s for you personally to demonstrate to them the door.

Remember that! It’s important that you along with your economic expert (whomever it ends up becoming) are on exactly the same web page. You desire a consultant that has a lasting investing strategysomeone who’ll motivate you to definitely hold trading consistently whether or not the market is upwards or down. tax planning copyright. In addition don’t should assist someone that forces that purchase something that’s also dangerous or you are not comfortable with

Unknown Facts About Ia Wealth Management

That go to the website combine will provide you with the diversification you ought to successfully invest the longterm. As you study economic experts, you’ll most likely find the phrase fiduciary responsibility. All this indicates is any advisor you employ has to work in a manner that benefits their unique client rather than their self-interest.

Report this page